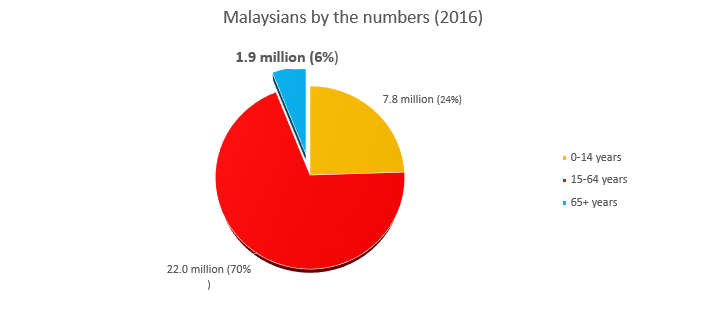

Malaysia defines a senior citizen as someone above the age of 60, and according to the Statistics Department, those above 65 years old make up 1.9 million, or 6% of the population.

By 2030, the United Nations estimates an elderly population uptick to 15%, officially turning Malaysia into an ageing country.

Everyone ages and while retirement may be comforting, it is also nerve-racking. Retirees no longer enjoy the routine of drawing a monthly salary, meaning a heavy reliance on savings and pensions.

Latest data suggests that Malaysians are living longer, beyond the national average. While that is a good thing, it also leaves a larger number of people susceptible to illnesses such as dementia and Alzheimer’s, which are typical among senior folk.

Source: Department of Statistics Malaysia

Studies also found that people’s financial abilities decline from the age of 50 years old. To make matters worse, a person could be making a bad decision but feel perfectly happy with it. Such a bizarre example is actually normal as one ages.

The population boom comes at a time when Malaysians are wrestling with the rising cost of living and struggling to make ends meet.

One day they will have to confront ageing, either in the form of taking care of themselves as they age or even taking care of their elderly parents. Regardless of the circumstance, it involves money.

Here are a few scenarios that you need to consider when you are planning for your retirement:

Semi-independent living

Say, you are ageing healthily and have no major complications but may need some assistance such as house chores, which involves hiring a maid. You have paid your mortgage and car loan and have no outstanding loans and debts and want to live a simple lifestyle.

Here’s how much you’ll spend on average in a year in today’s value:

| English-speaking maid RM1,400 X 12 months | RM16,800 |

| Medical check-up at a private hospital | RM1,500 |

| Medication & supplements RM150 x 12 months | RM1,800 |

| Annual premium for medical insurance | RM3,500 |

| Groceries RM700 x 12 months | RM8,400 |

| Transport (petrol & toll) RM200 x 12 months | RM2,400 |

| Yearly 3-day holiday within Malaysia | RM1,000 |

| Utilities (water, electricity, etc.) RM150 x 12 months | RM1,800 |

| Total | RM37,200 |

However, this is a very conservative estimate and disregards many of the complications related to old age.

It merely assumes that the elderly person is able to live semi-independently with minimal assistance. However, that is not always the case.

As we age, our mental and physical health deteriorate, and we may find living on our own no longer an option at one point. This is when assisted living comes into the picture.

What’s the price of assisted living?

The thought of sending the elderly to a nursing home may be frowned upon in Asian culture. But taking care of an aging loved one is not easy and is a round-the-clock commitment.

Also, very few have the luxury of staying at home and tend to their family members full–time.

This is when assisted living arrangement can be considered to ensure the elderly person is taken care of comfortably.

For a semi-private room with basic care services, the average price is RM1,000 a month. A private room with trained nurses and in-house doctors providing professional and specialised healthcare will set a person back RM5,000 a month. Diapers and other services may be charged separately.

| Twin Sharing Room | |

| Walking, assistance with ADLS | RM2,500 |

| Bed-Ridden | RM2,650 |

| Multiple Sharing Room ( 3-, 4- or 5-bedroom) | |

| Walking, assistance with ADLS | RM2,300 |

| Bed-Ridden | RM2,450 |

| Single Room | |

| Single room with shared bathroom | RM2,850 |

| Single room with attached bathroom | RM3,250 |

| Couple | RM3,800 |

| Diapers (per month) | RM300 |

Prices include: 24-hour care, assistance and nursing; health check-ups; six meals a day; reflexology/massage; physiotherapy; Astro TV; laundry.

*All rooms are fully air-conditioned.

*Medical-related fees are charged separately and prices vary according to care and treatment.

Source: Eldercare Nursing Home

Even if someone is in the pink of health, it has been advised to save up for a year’s stay at a nursing home.

| Multiple-sharing room RM2,500 x 12 | RM30,000 |

| Diapers RM300 x 12 | RM3,600 |

| Medical check-up at a private hospital | RM1,500 |

| Medication & supplements RM150 x 12 months | RM1,800 |

| Annual premium for medical insurance | RM3,500 |

| Total | RM40,400 |

That’s quite a huge sum to pay over a year. If one is required to stay in an assisted living environment long-term, you are looking at RM202,000 for five years. This cost does not involve medical expenses, such as check-ups, treatments and medication.

What if a senior citizen falls ill?

The top criterion that determines if someone elderly needs assistance or is able to live independently is his or her health condition.

According to the World Health Organisation, the top killer diseases among Malaysians are coronary heart disease and stroke.

Also in the country, the medical inflation rate is between 10% and 15% every year, and these diseases are not cheap to treat.

Treatment for heart attack costs between RM10,000 and RM30,000. In 30 years’ time, it will be around RM174,494 to RM523,482.

As for stroke, expect to pay RM35,000 to RM75,000. In 30 years, that will be from RM610,729 to RM1,308,705.

This cost will be on top of the living costs detailed above and it will likely wipe out a person’s retirement savings if he/she does not have adequate medical insurance coverage.

So, how much do you really need during retirement?

With the above scenarios in mind, you need to prepare for your retirement early to ensure adequate savings in your old age.

Assuming life expectancy of 75 years old, here’s a rough estimate of the total retirement savings that you need:

| Total in today’s value | Inflation adjusted total (2% p.a.) | |

|---|---|---|

| First 5 years Independent living at RM36,000 a year | RM180,000 | RM326,045.09 (in 30 years) |

| Next 5 years Semi-independent living at RM37,200 a year | RM186,000 | RM371,979.46 (in 35 years) |

| Last 5 years Assisted living at RM40,400 a year | RM202,000 | RM446,024.01 (in 40 years) |

| RM1,144,048.56 | ||

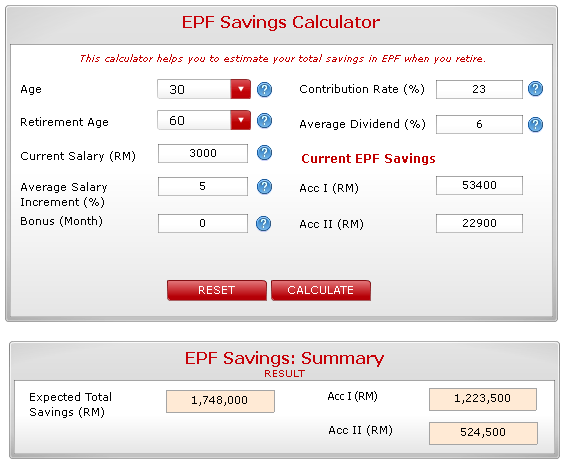

Let’s say you are 30 years old and expect to retire when you are 60, the maximum age set for private-sector workers under the Minimum Retirement Age Act 2012, here’s how you can save up for the amount above:

Assuming you start working at the age of 22 with RM2,000 monthly starting pay. Source: EPF/KWSP

Tip: One way to begin estimating your retirement costs is to take a close look at your current expenses in various categories, and then estimate how they will change. For example, your mortgage might be paid off by then – and you won’t have commuting costs.

Bottom line

Choosing whether to live independently or assisted boils down to myriad factors with financial and physical health topping the list.

In the long run if someone is fit as a fiddle, living independently costs less, but that depends on the person’s lifestyle before and during retirement.

If you are about to retire and think of roughing it out on your own, it’s best to ensure that you are in good health and you are on track in clearing debts. Being saddled with loans and mortgages will not only dent your chances of living independently but even make retirement an impossible dream.

Also factor in declining cognitive functions. Here is where you will need to have a companion or someone trustworthy to still check in on you from time to time. There are also a few handy apps to have in case of emergencies such as Doctor2U, an app that allows you access to doctors 24 hours, seven days a week.

If you have health complications and do not want to burden your family, then assisted care would be best as you will have someone to check on you from time to time. Some nursing homes have day care or even seasonal options where you only need to check in for a certain duration as opposed to full boarding.

If you are young with retirement years away, then it is best to protect that dream. Tap into your EPF Members Investment Scheme, where you will be able to invest a percentage of your savings in Account 1 in approved unit trust funds. The additional returns, if any, can boost your chances of surviving through retirement.

Learn to be financial literate and not only how to invest in stocks, shares and futures, to name a few, but to also be frugal and cut spending where necessary. Never neglect your health either. Yearly medical checks and an active lifestyle might help mitigate the effects of ageing.