Financial Adviser's Representative (FAR) Programme & Islamic Financial Adviser's Representative (iFAR) Programme - BNM

Introduction of FAR Programme

The regulatory and supervisory framework of Malaysia enters a new stage of its development as the Financial Services Act 2013 (FSA) and Islamic Financial Services Act 2013 (IFSA) come into force on 30 June 2013.

The FSA and IFSA is the culmination of efforts to modernise the laws that govern the conduct and supervision of financial institutions in Malaysia to ensure that these laws continue to be relevant and effective to maintain financial stability, support inclusive growth in the financial system and the economy, as well as to provide adequate protection for consumers. The laws also provide Bank Negara Malaysia with the necessary regulatory and supervisory oversight powers to fulfil its broad mandate within a more complex and interconnected environment, given the regional and international nature of financial developments. This includes an increased focus on preemptive measures to address issues of concern within financial institutions that may affect the interests of depositors and policyholders, and the effective and efficient functioning of financial intermediation.

It is important that Malaysia’s regulatory and supervisory system is adequately equipped to respond effectively to new and emerging risks so that confidence in the financial system is preserved and that the critical financial intermediation activities which are vital to the economy are not disrupted. The FSA and IFSA amalgamate several separate laws to govern the financial sector under a single legislative framework for the conventional and Islamic financial sectors respectively, namely, the Banking and Financial Institutions Act 1989 (BAFIA), Islamic Banking Act 1983, Insurance Act 1996 (IA), Takaful Act 1984, Payment Systems Act 2003 and Exchange Control Act 1953 which are repealed on the same date.

The new laws will place Malaysia’s financial sector, encompassing the banking system, the insurance/takaful sector, the financial markets and payment systems and other financial intermediaries, on a platform for advancing forward as a sound, responsible and progressive financial system. This is especially important to enable the financial system to meet the new demands for financing associated with Malaysia’s economic transformation programme both during and beyond the next decade, the changing demographics of our population, and the increasing integration of the Malaysian economy with the region and the world.

Bank Negara Malaysia also wishes to highlight the following salient requirements in FSA and IFSA, mostly requirements brought forward from the repealed laws:

Copies of the FSA and IFSA are available on Bank Negara Malaysia’s website. Any query relating to the provisions of FSA and IFSA may be directed to FSAandIFSA@bnm.gov.my.

Those who are interested to obtain further information on the licensing requirements of Financial Advisers may contact Consumer and Market Conduct Department, Bank Negara Malaysia, at the telephone number 03-2698 8044 or visit the Bank’s website at https://www.bnm.gov.my.

Key features of the new legislation include:

- Greater clarity and transparency in the implementation and administration of the law. This includes clearly defined regulatory objectives and accountability of Bank Negara Malaysia in pursuing its principal object to safeguard financial stability, transparent triggers for the exercise of Bank Negara Malaysia’s powers and functions under the law, and transparent assessment criteria for authorizing institutions to carry on regulated financial business, and for shareholder suitability;

- A clear focus on Shariah compliance and governance in the Islamic financial sector. In particular, the IFSA provides a comprehensive legal framework that is fully consistent with Shariah in all aspects of regulation and supervision, from licensing to the winding-up of an institution;

- Provisions for differentiated regulatory requirements that reflect the nature of financial intermediation activities and their risks to the overall financial system;

- Provisions to regulate financial holding companies and non-regulated entities to take account of systemic risks that can emerge from the interaction between regulated and unregulated institutions, activities and markets. The Minister of Finance may subject an institution that engages in financial intermediation activities to ongoing regulation and supervision by Bank Negara Malaysia if it poses or is likely to pose a risk to overall financial stability;

- Strengthened business conduct and consumer protection requirements to promote consumer confidence in the use of financial services and products;

- Strengthened provisions for effective and early enforcement and supervisory intervention

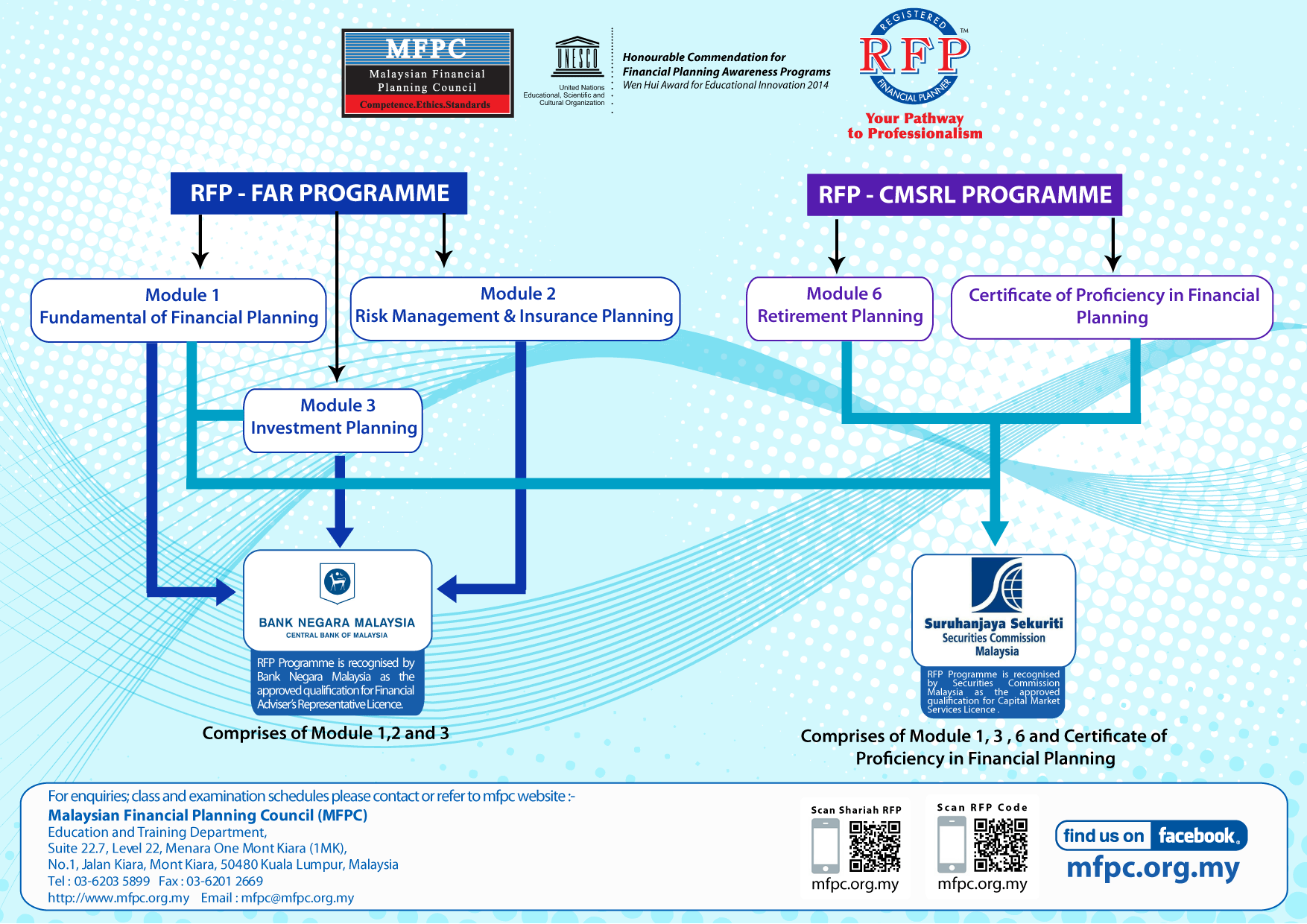

Financial Adviser’s Representative (FAR) Programme Module

| Module | Descriptions |

|---|---|

| Module 1 | Fundamentals of Financial Planning |

| Module 2 | Risk Management & Insurance Planning |

| Module 3 | Investment Planning |

Islamic Financial Adviser’s Representative (iFAR) Programme Module

| Module | Descriptions |

|---|---|

| Module 1 | Fundamentals of Shariah Financial Planning |

| Module 2 | Risk & Takaful Planning |

| Module 3 | Shariah Investment Planning |

BANK NEGARA REQUIREMENTS

New FA applicants to fill-up for the purpose of submitting application to conduct FA / Islamic FA business:-

Applicants are also required to submit a 3-year business plan tabling projected revenue/expenses/PBT/shareholders’ fund and support the business plan with sufficient details on the basis of projections e.g. list of potential clients/existing clients/past commission statements. Do elaborate on how the plan will be executed and be specific on the focus of business e.g. breakdown by type/class of business (ordinary life / investment-linked insurance or if the applicants are also venturing into general insurance business – marine/fire/motor etc).

If the applicant is currently a company already in operation, do provide a copy of the last 3 years’ audited financial statements of the company. Please inform us if the applicant is also applying for Financial Planning(FP) Licence from the Securities Commission (SC) or has already obtained FP licence from the SC.

With effect from 2015, the minimum paid-up capital has been revised to RM50K and the minimum qualifications for FAR were revised to at least Modules 1, 2 & 3 of RFP/CFP/IFP/Shariah RFP. Other requirements as defined in the attached Guidelines remain unchanged.

For any enquiries, do call the following officers:

Tel : 03-26988044

Mimi (ext 7848), Sumathi (ext 8829), Thamaratul (ext 7845), Roselina (ext 8050) or email mimi@bnm.gov.my

- Please click for FA Guidelines

- Please click for Application Form(New)

- Please click for Corporate Shareholder

- Please click for Director Form

- Please click for FAR Form

- Please click for Individual Shareholders

- Please click for CEO Declaration Form

- Please click for Director Declaration Form

MFPC Professional Progression Programme (MPPP)

|  |

For registration, please contact:

Ms. Azizah

Association of Financial Advisers (AFA) Malaysia

Email: secretariat@afamalaysia.org

Tel: +60 16-382 8828

For registration, please contact:

Ms. Azizah

Association of Financial Advisers (AFA) Malaysia

Email: secretariat@afamalaysia.org

Tel: +60 16-382 8828

For further assistance, please contact the Education Department at 03-62035899 or email to education@mfpc.org.my.