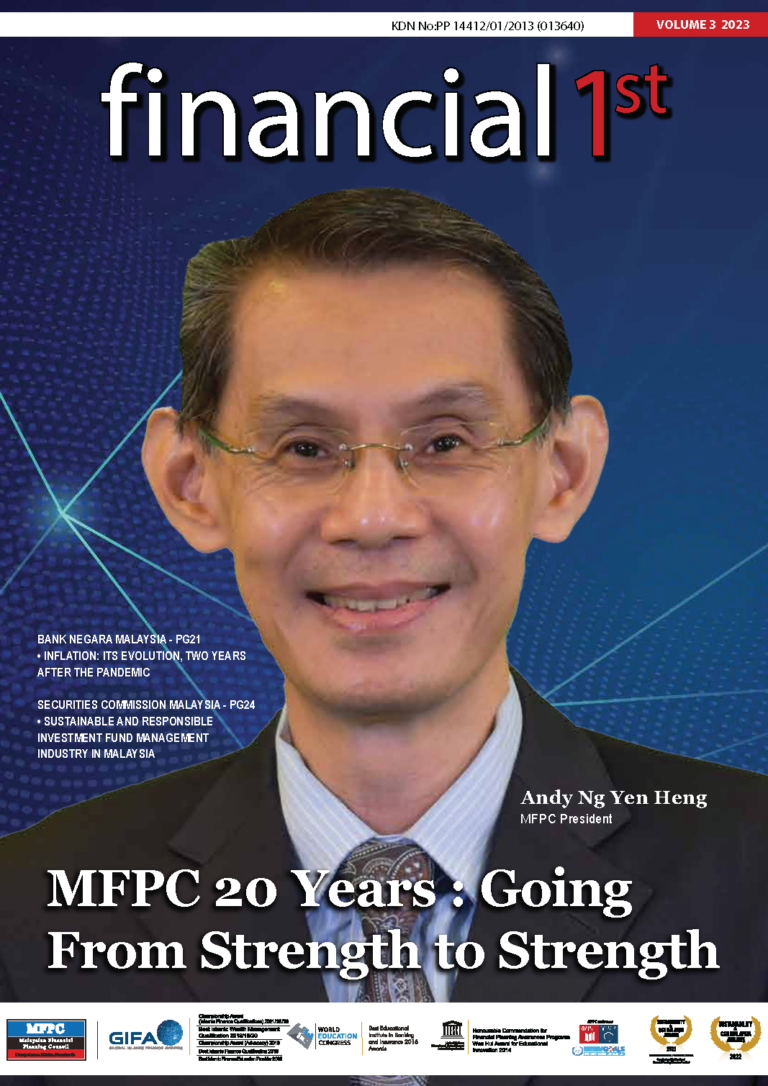

MFPC is an independent body set up with the noble objective of promoting nationwide development and enhancement of the financial planning profession. MFPC provides an evolving set of Best Practice Standards and Code of Ethics that must be adhered to by Registered Financial Planner (RFP) and Shariah RFP designees.

Upcoming Events & CPD Programmes

Upcoming Events

awards

We are honoured to be recognised by Jury’s of the following Awards. We remain estatic to continue providing financial planning education to the financial services industry in Malaysia including to the banking sector, insurance, takaful, financial advisory and capital markets.

MFPC Chapters

MFPC has expanded to various state including Penang, Johor, Sarawak, Sabah and East Coast to promote financial Literacy among Malaysian.

See what our programme participants says

Latest Memo / Notice

FAQ

MFPC (Malaysian Financial Planning Council) membership is a prestigious recognition that signifies your commitment to professionalism, integrity, and excellence in the financial planning field. As an MFPC member, you gain access to a wealth of networking, development, and progression opportunities1.

Here are some key points about MFPC membership:

- Purpose: The MFPC aims to promote nationwide development and enhancement of the financial planning profession.

- Best Practice Standards and Code of Ethics: MFPC provides an evolving set of standards and ethical guidelines that must be adhered to by Registered Financial Planners (RFP) and Shariah RFP designees2.

- Benefits of Membership:

- Professional Recognition: Being an MFPC member demonstrates your commitment to high standards.

- Networking Opportunities: Connect with other professionals in the field.

- Development Programs: Access training and development resources.

- Career Advancement: Stay updated with industry trends and enhance your skills.

- Membership Types: MFPC offers various membership types, each with its own entrance fees and yearly subscriptions3. These include:

- Associate Membership

- Affiliate Membership

- Registered Financial Planner (RFP) Membership

- Shariah RFP Membership

For detailed information on membership fees and guidelines, you can visit the official MFPC website. If you’re passionate about financial planning, consider joining this esteemed community! 🌟

The Malaysian Financial Planning Council (MFPC) is an independent body established with the noble objective of promoting nationwide development and enhancement of the financial planning profession. Here are the key points about the MFPC Code of Ethics:

Integrity:

- RFP Designees (Registered Financial Planners) must always act in the best interests of their clients and the public.

- They are expected to uphold the highest degree of integrity in all professional engagements.

- As guardians of public trust, RFP Designees must demonstrate impartiality, honesty, and transparency in their dealings.

Transparency:

- RFP Designees should remain transparent and impartial in all interactions.

- When impartiality is compromised due to practical reasons, they must clearly explain the rationale to clients.

- Conflicts of interest should be disclosed honestly in the client-planner relationship

The MFPC’s mission includes certifying financial planners, enhancing the image of the financial planning profession, setting practice standards, providing self-regulation, and promoting financial literacy among Malaysians1.

For more detailed information, you can refer to the official MFPC website2. Remember that this code of ethics ensures that the public receives high-quality financial planning services from professionals adhering to these standards.